As we do every weekend, we are going to analyze the market and review the success of our techniques over the past week: the first week of March.

Let’s take a look at what is happening in the markets and we’ll start by reviewing the SP.

MINISP FUTURES

Today we will begin our review with an exercise which will help us understand what is happening in the market. To do so, we will compare what would have been our results had we executed our techniques every day over the last two weeks, regardless of macroeconomic data announcements, with the results we would have obtained had we executed the inverse of our techniques.

The following is a chart of the last two weeks from Monday, February 22nd, until Thursday, March 4th. We have not included data from March 5th as, with the announcement of unemployment data in the US, it is not generally a good trading day for us, due to the volatility often caused by this announcement.

We see that during these 9 sessions, the market went down to 1115 from 1084 and then later rose from 1084 to 1125, the maximum price for March 4th. On the surface, this range appears to be ample and we have three hours per day to enter and exit with our trades and the numbers in this range should be good.

Now, take a look at the chart below. Had we executed all the trades specified by our techniques, we would have registered a loss of -35 points and, had we executed the inverse of these trades, we would have made a gain of +7.75 points.

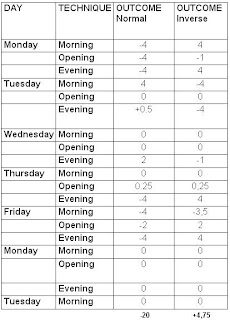

But let’s scrutinize the data a bit more. We are going to omit operations that we should not have made due to the announcement of macroeconomic data.

Notice that, for normal operations, our outcome improves from -35 to -20 but for the inverse trades, the outcome is worse, as it changes from +7.75 to -4.75.

Take a look at the following chart. You’ll see that, during three time frames, the SP went from 1115 to 1084 (31 points) and later recovered 41 points and none of our techniques were able to take advantage of these points when, in many occasions, without any difficulty, our techniques generally give us gains of up to

40 points weekly.

Now we will analyze the charts in more detail: first the fall from 1115 to 1084 and then the rise. In four hours, it fell 31 points only to later become stagnant.

And take a look at the rise.

Can a trader make money in this market? From our perspective right now, the only way to do so would be to raise stops and objectives and, even then, we don’t believe the last two weeks would have been profitable, basically because the movements we’ve seen are fast. The index rises with two movements and then we have three sessions, like the last three in the 7-9 point range which gives us no option to make any positive gains.

We continue to work on new options and new techniques for the SP although the problem we are seeing, from our point of view, is not due to a problem with our techniques, which have worked quite well over the last several months. Rather, the problem is that the SP is behaving in a way we have seen very rarely and, above all, the ranges have become narrower over the last several months. For instance, at the end of 2008, we saw ranges of up to 350 points per month. At the beginning of 2009, the ranges were approximately 145 points. Meanwhile, over the last several months the ranges between maximum and minimum price for the SP Futures have been even narrower; 48 points in December, 82 in January and 74 in February.

We have high hopes that the market will soon return to what it once was and we can again exploit our SP techniques as we did over the previous months.

FOREX

Let’s now see what happened with Forex trading this last week.

Since the previous Friday, our problem has been the Eur/Jpy, both for the European and USA morning techniques. The problem is due to the fact that, as we saw until yesterday, for the last 6 sessions the Eur/Jpy has been in a range of no more than 140 pips. Our techniques are not effective with a range of only

140 pips as they are based on price variations that break maximums or minimums. Therefore, since this past Tuesday, we have stopped operating our techniques with the Eur/Jpy, as it did not make sense to trade them with the market this inactive.

What would have happened had we executed the inverse of our techniques? In other words, trading short at the long entry point and vice versa, trading long ad the short entry point. For this analysis, we will not take into consideration reverses. We will only consider the first order that is triggered.

For Thursday’s session, these would be the inverse trades to what our technique prescribes. If we were to apply our normal technique, the entry prices would be interchanged: Long at 121.64 and short at 120.78.

Look what would have happened. The short would have been triggered at

121.64, the price would have gone up to 121.8 and then fallen to 120.50, hitting the target at 120.78 and giving us a gain of 86 points.

For Wednesday’s session, this same strategy would also have worked but it is clear that this is temporary because if we reverse the chart for Eur/Jpy FOR THE PAST YEAR, we would not have found many inactive sessions with such narrow ranges and it is clear the pair has been punished strongly and now is completely stagnant.

These are the operations we execute this past week.

As you can see, it has been a difficult week for both Forex and Sp. All we need to do is know how to read these market moments well to try to come out of this situation in the best possible position so that when the market returns to its normal character, we can continue to rack up point in the SP and pip in Fx as we have in the last years.

Have a nice weekend!

No comments:

Post a Comment